- Introduction

This Clients’ Money Policy applies to all partners, employees, contractors, and agents of Weldon Beesly LLP, a Limited Liability Partnership registered in England and Wales under number OC417840, whose office is at 100 South Street, Bishop Stortford, Hertfordshire CM23 3BG (“the Firm”) who have authorised access to client money and client deposit bank accounts (“Users”).

The Firm will manage clients’ money effectively in order to deliver an appropriate level of confidence to RICS, firms’ clients, potential clients and stakeholders. RICS Rule 8 states “A Firm shall preserve the security of clients’ money entrusted to its care in the course of its practice or business”.

The words stated in bold are defined in the glossary at the end of this help sheet.

- Aim

To ensure that clients’ money can be clearly linked to the clients to whom it belongs and is protected on their behalf at all times and in particular, in the following circumstances:

- insolvency

- death of a sole practitioner

- misappropriation by any party

- transfer of client money to another organisation.

Should clients’ money be misappropriated, the Firm must inform RICS and, where appropriate, the Police and their insurers.

- General Principles

The Firm should ensure that:

- Users have clear segregation of duties and responsibilities and that a Principal or appropriately qualified individual oversees the client accounting function

- They employ competent and knowledgeable staff who are responsible for processing clients’ money and who are familiar with RICS Rules

- Accounting systems and client data are securely controlled and protected

- Computer systems are adequately protected for access, firewalls, back ups and disaster recovery

- There is adequate cover for holiday and long term absence

- Principals cannot and do not override controls surrounding the accounting system

- All departments and branches apply the same level of controls in relation to the client accounting function.

- Client Bank Accounts

The Firm should ensure that:

- They hold clients’ money in one or more client bank accounts separate from all other monies. Client money should be available on demand

- The bank account is correctly titled to include the name of the firm and the word “client” to distinguish the account from an office or any other account. If it is a discrete account, the name of the client should be included in the account title

- They have obtained written confirmation from the bank of the client account conditions

- They have advised clients in writing of the bank account details (account name and name and address of the bank) and agree the terms of the account handling, including arrangements for interest and charges

- They have obtained written consent from their client if the firm is to retain interest.

- Client Accounting Systems and Controls

The Firm should ensure that:

- Accounting records and systems are appropriate to the nature and volumes of client account transactions. The Firm have purchased the Landmark Client Accounting Module software to enable the firm to manage client money effectively

- Systems provide details of all money received into and paid from all client accounts and show a running balance of all client money held in that account

- Systems identify all receipts and payments to the client to which they relate; for example by means of client ledgers showing cash balances held on behalf of clients at all times

- Accounting records are completed chronologically and promptly

- The current balances at the total and client levels are always available

- All ledgers have the client name and an appropriate description, e.g. the property address

- Overdrawn balances on client ledgers are prevented by the systems or controls in place and where they do occur are investigated and rectified immediately

- Adequate controls are in place over unidentified client money to ensure that such funds are kept securely. The client should be located and reimbursed as soon as possible. Such funds held for more than six years may be donated to a registered charity

- A central list of client bank accounts is maintained including dates of opening and closing of accounts

- They complete a “three way” reconciliation at least once every month where clients’ money is held in a general client account.

This should be produced as a formal statement with any unresolved differences or adjustments being fully investigated and explained. Any errors identified in the reconciliation process should be promptly rectified.

General client account reconciliations should include a full list of:

- client ledger balances and the total of the balances

- dated unpresented cheques

- dated outstanding deposits

- details of any other reconciling items

For discrete accounts the monthly reconciliations should agree the cash book or

system balances to bank statement balances and include a full list of:

- dated unpresented cheques

- dated outstanding deposits

- details of any other reconciling items

- system reports supporting reconciliation figures as appropriate.

Reconciliations should not include regularly occurring adjustments or reconciling items more than three months old, except for unpresented cheques which should be no more than six months old.

- reconciliations should be reviewed and signed off by a Principal or an appropriate independent senior member of staff

- client accounting records, including copies of reconciliations, are securely kept for at least six years plus the current year.

- Controls over the receipt of client money

The Firm will ensure that:

- only a Principal or appropriate staff independent of accounting staff open incoming post

- procedures exist to ensure all clients’ money is banked within three working days

- all cash and cheques received by post or by hand are promptly recorded

- a reconciliation is performed between money received by post and that day’s banking

- procedures exist to identify and distinguish between clients’ and office money

- mixed monies are initially paid into a client account and the office element paid to the office account when the receipt has cleared the bank

- fees received in advance for professional work not yet billed are paid into a client account pending completion of the work

- duplicate receipts are issued for cash received and controls over the physical security of cash are effective

- unbanked client money receipts are kept secure.

- Controls over the payment of client money

The Firm will ensure that:

- checks are made to ensure that sufficient funds are held on behalf of the relevant client before payments are made

- a copy of the bank mandate is held and is up to date

- adequate authorisation and supervision procedures are in place for payments made by cheque, bank transfer and electronic methods

- insurance and adequate Principal supervision is in place where payments are made by non principals

- all payment requests have supporting evidence and that documentation has been authorised in advance by a Principal or other appropriate person

- blank cheques are not signed, and unused cheques are kept securely

- effective controls are in place over the setting up of new supplier accounts on the system

- cash payments are avoided.

- Misuse and Compliance

- Any User found to be misusing the Firm’s clients’ monies will be treated in line with the Firm’s Disciplinary Policy and Procedure. Misuse of the clients’ monies will be a criminal offence.

- RICS and the Firm’s insurance company will be informed of any suspected misuse.

- Where any evidence of misuse of the Firm’s Clients’ Money Policy is found, the Firm may undertake an investigation into the misuse in accordance with the Firm’s Disciplinary Policy and Procedure. If criminal activity is suspected or found, the Firm may hand over relevant information to the police in connection with a criminal investigation.

Glossary

Bank mandate

The bank account mandate is created when the account is set up and is a contract between the bank and the firm setting out terms and conditions of the use of banking services. It states the respective rights and obligations of the bank and the firm and includes the names of individuals authorised to sign cheques or to make electronic payments.

Blank cheques

A blank cheque is a cheque signed by an authorised signatory but which has not been completed with the name of the payee or the amount to be paid. In the past, blank cheques have been pre-signed so that the cheque details can be completed and dispatched by a person not authorised to sign cheques.

Cash book

A cash book is a record of all clients’ receipts and payments in chronological order which normally provides a running balance of the total amount of client money held by the firm at all times. A cash book report is available where computerised systems are used.

Clients’ money

Clients’ money is any money received by a firm, in the course of its business activities that does not wholly belong to it or any Principal or Principals of the firm.

Examples of clients’ money include:

- tenants’ deposits

- rents

- service charges

- interest credited to a client account (unless interest is retained by the firm by agreement)

- Arbitration fees

- fee money taken in advance

- clients’ money held but due to be paid to contractors

- money held by members appointed as a Receiver

- sale proceeds and deposits

- auction sale proceeds

Please note that the above list is not exhaustive and there may be other examples of clients’ money.

Client bank account – general

A client bank account which holds client money belonging to more than one client.

Client bank account – discrete

A client bank account which holds clients’ money belonging to a single client, also known as a designated client bank account.

Client bank account conditions

The client bank account operating conditions define the manner in which the account is conducted. The firm should ask the bank to confirm in writing that:

- all money standing to the credit of that account is clients’ money

- the bank or building society is not entitled to combine the account with any other account or to exercise any right to set-off or counter claim against money in that account in respect of any sum owed to it on any other account of any Principal or the firm

- any interest payable in respect of monies held in the account shall be credited to that account except where there is written agreement from the client for the interest to be retained by the firm

- any charges or interest levied in respect of a general client account shall not be debited to it.

Client ledgers

Client ledgers record the details of all payments and receipts relating to a client in chronological order. Ledgers will normally provide for a running balance which shows the amount of money held by the firm on behalf of that client at all times. Client ledgers are necessary where general client bank accounts are in use. Client ledgers may be handwritten, on spreadsheets or within a computerised system.

Mixed monies

Receipts which combine clients’ money and office money in a single amount.

Office money

Receipts which belong wholly to the firm or Principals. One example is payment of fees.

Outstanding deposits

Receipts which have been paid into the bank but have not yet appeared on the bank statement, also known as outstanding lodgements.

Overdrawn balances

An overdrawn balance on a client ledger within a general client account means that payments have exceeded the amount of money held on behalf of that client. This means other clients’ money is being used to fund the expenditure relating to the client with the overdrawn balance.

The cash book balance is said to be overdrawn where the cumulative total of recorded payments exceeds that of accumulated receipts. The bank account is overdrawn if that is the position shown by bank statements. In each case, there is an overall shortage (or deficit) of client money.

Principal

A Principal of an RICS regulated firm means:

- sole practitioner

- partner, director or member of a Limited Liability Partnership

- person whose job title includes the words “partner” or “director”

- person who performs the functions of a sole practitioner, partner, director or member of a limited liability partnership.

Reconciling items

Reconciling items are commonly unpresented cheques and outstanding deposits which account for the difference between the cash book balance and the bank statement balance. These are receipts and payments recorded in the cash book but which have not yet cleared the client bank account. Other reconciling items are items which have appeared on the bank statement but are not yet recorded in the client accounting records; for example, unidentified receipts.

Running balance

A cash book or client ledger balance which is updated every time a payment is made or a receipt recorded and so always shows the current position.

System reports

Where accounts packages are used, reports should be printed to evidence the figures in the monthly reconciliations. Typically hard copy reports of cash book transactions for the month, including a cash book balance and a report of client ledger balances (to include a total at the reconciliation date) would be produced. Most systems are capable of producing a reconciliation report.

Three – way reconciliation

This applies only where the firm operates a general client account. The aim is to reconcile the bank statement balance to the total of client money held, as recorded by the cashbook, and then to the total of the individual client balances, as recorded on the client ledgers at the same date.

Unidentified client money

A firm may hold client money where the beneficiary is unknown or cannot be traced so preventing payment to the client. Examples of such “orphan funds” include unidentified receipts, old unpresented cheques for deposits refunds or contractors’ payments. Some firms “inherit” surplus clients’ monies when Practices are acquired.

Unpresented cheques

Cheques which have been sent to the payee but not yet presented for payment and cleared by the bank.

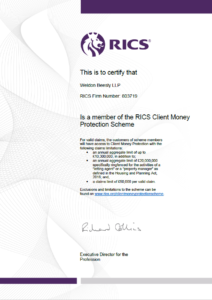

CMPS Certificate – Weldon Beesly LLP